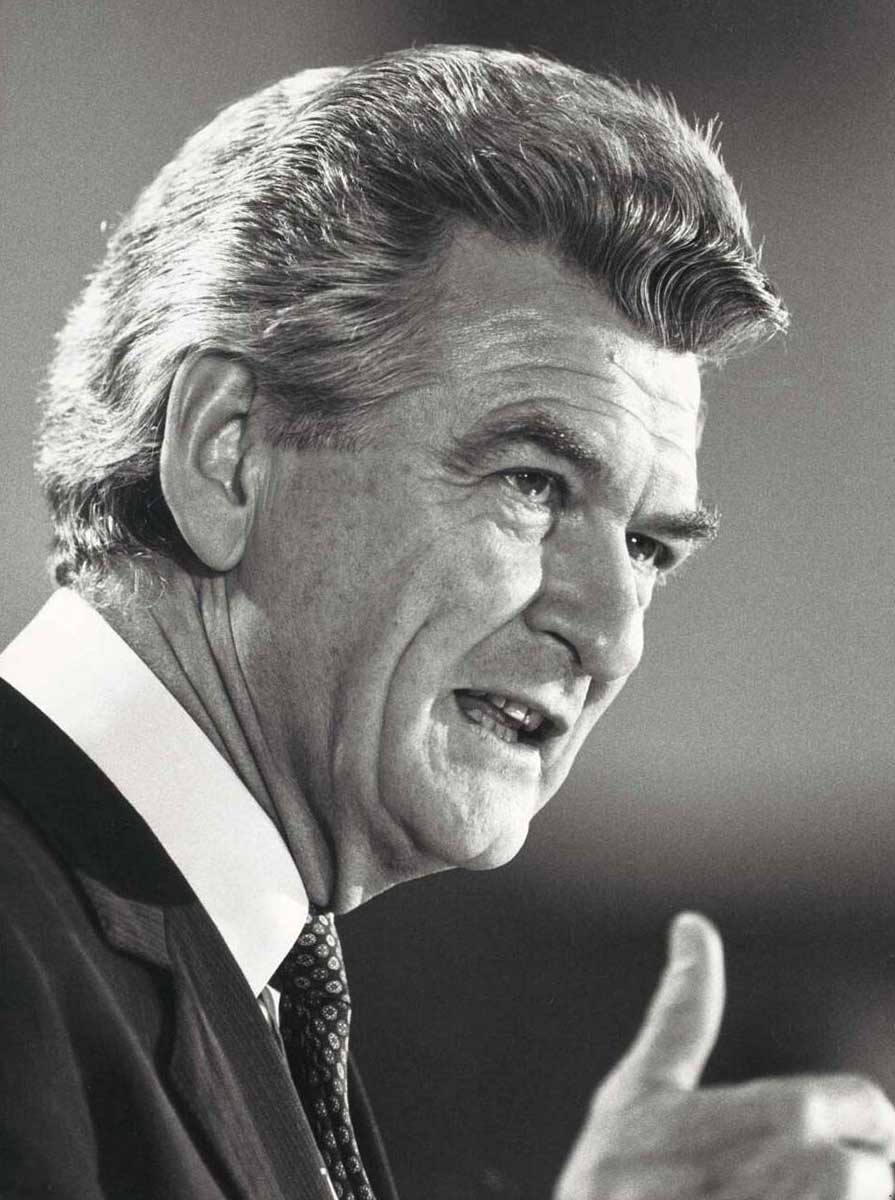

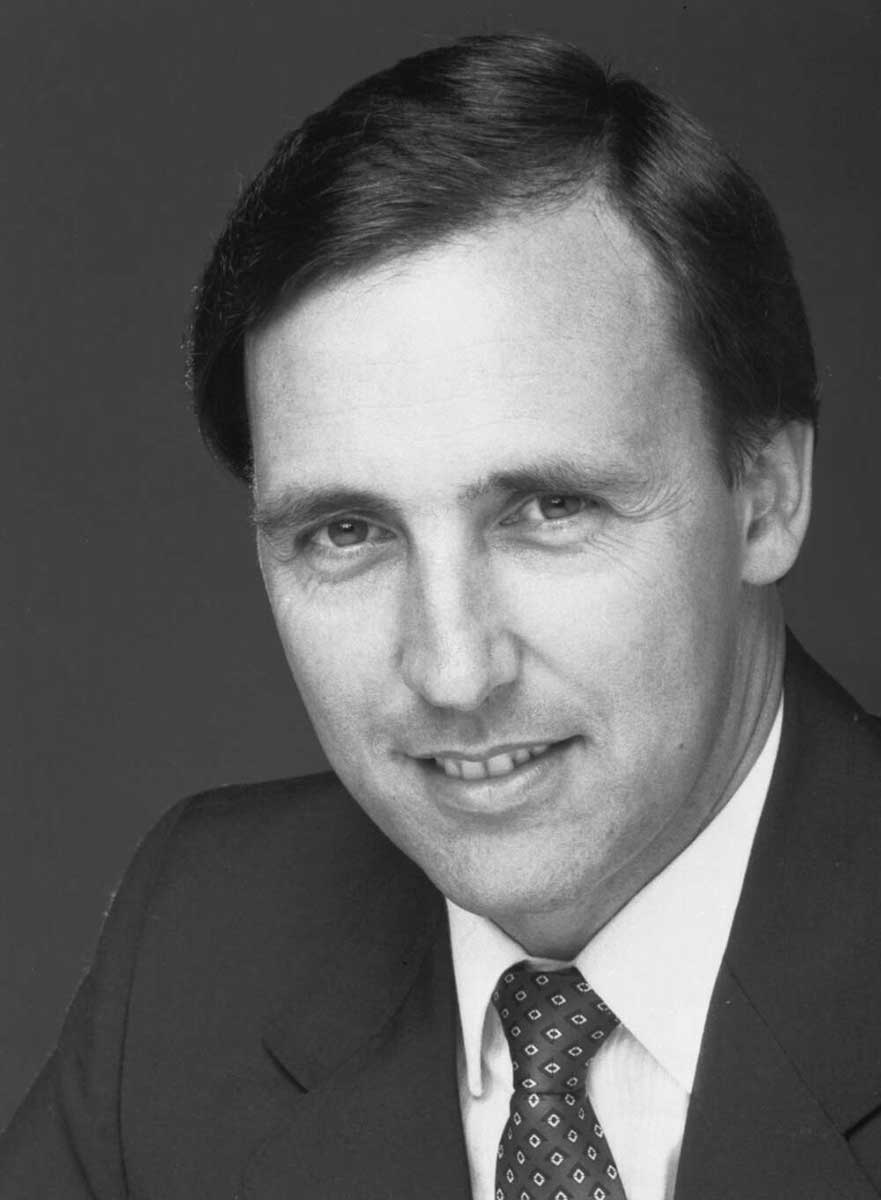

In 1983 the newly elected Labor government, with Bob Hawke as Prime Minister and Paul Keating as the Treasurer moved the Australian dollar onto a floating exchange rate.

This meant that the dollar was now valued through the supply and demand of money within world currency markets.

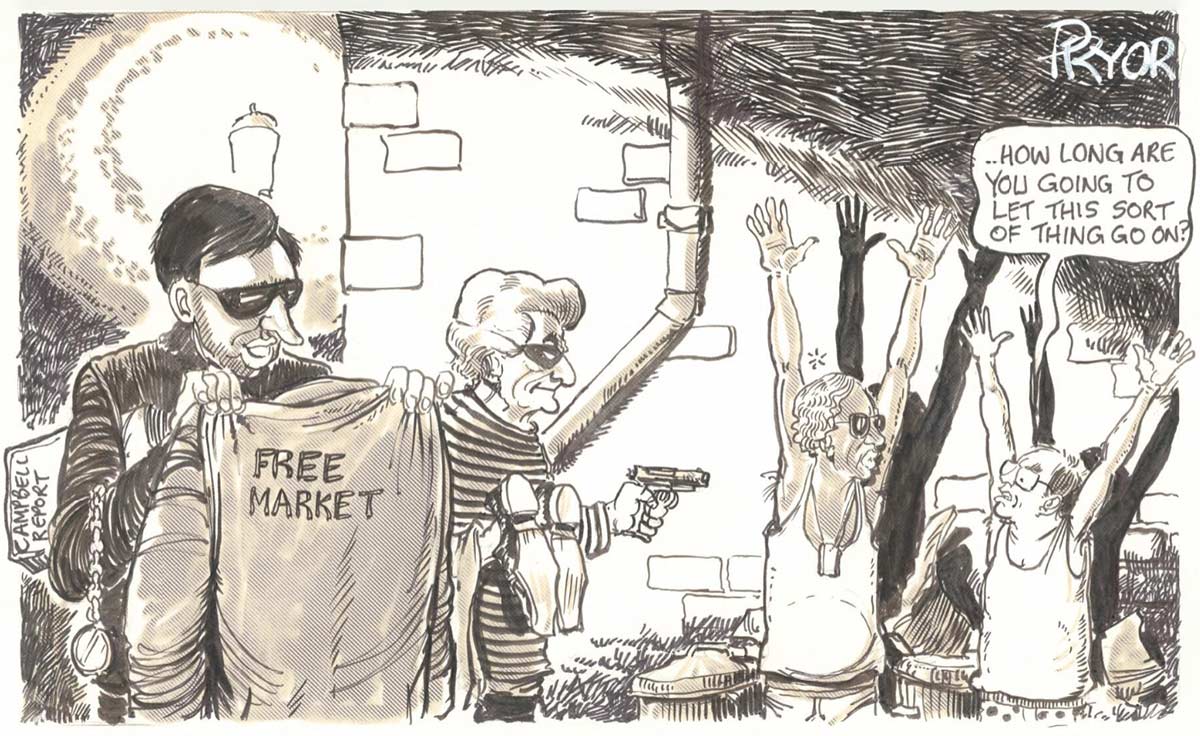

The currency float created the groundwork for a series of deregulations initiated by the Hawke and Keating governments, including the licensing of foreign banks, loosening of restrictions around loans, lowering of tariffs and the move away from centralised wage regulation.

Dick Bryan, economist, Sydney University:

There was no alternative. Australia could have been the Thailand of the Asian economic crisis if it hadn’t floated.

Evolution of the float

Prior to 1983 the value of our currency (the Australian pound then, after decimalisation, the Australian dollar) was always pegged to that of another currency (the British pound, then the US dollar), and then a moving peg in relation to a basket of currencies.

The actual value of the dollar under these systems was determined through a morning discussion between the Governor of the Reserve Bank of Australia and the heads of the federal government’s Treasury, Finance and Prime Minister and Cabinet departments.

The Reserve Bank could then use its foreign currency reserves to intervene in the market and manipulate the level of the dollar.

1970s economy

The world economy went through a series of shocks in the 1970s – the oil crisis of 1973 created a global recession that lasted until 1975, the rate of inflation progressively increased over the decade, another oil shock hit in 1979 and then another recession slowed the economy in 1980.

This rollercoaster of events created an unstable environment for financial regulators and within the Reserve Bank support grew for letting supply and demand in the world currency markets freely determine the value of the dollar. This is what is known as a fully floating exchange rate.

An internal memorandum written for the bank’s economic policy advisory committee in 1974 said, ‘floating the exchange rate would give maximum flexibility’, though it accepted that such an, ‘option may be ruled out on political and administrative grounds’.

This summed up the debate throughout the 1970s over changing the currency valuation system in Australia. Many in the Reserve Bank were open to change but politicians and other government departments, specifically Treasury, were opposed. This was because of concerns about the perceived lack of control government would have over the value of the dollar in a free-floating system.

1980s economy

The economic turmoil of the 1970s and early 1980s came to a head in 1983 in the lead-up to the March federal elections. Australia was suffering the effects of a lingering recession and double-digit unemployment.

Then in the two weeks leading up to the poll, more than $2.5 billion flowed out of the country, partly because of assertions by incumbent Coalition ministers about what a Labor government would do to the economy.

These huge movements of currency made it difficult for the Reserve Bank to stabilise the dollar. By this point, short-term investment rates had reached 150 per cent.

On the day after the election of the new government, the Prime Minister-elect Bob Hawke and his soon-to-be Treasurer Paul Keating met departmental officials and agreed to devalue the Australian dollar by 10 per cent. The devaluation created a significant inflow of currency.

Opposition to the float

Over the next few months, the newly appointed Governor of the Reserve Bank, Bob Johnston, openly encouraged Hawke and Keating to move to a floating exchange rate.

However, there was opposition from the Treasury Department whose head, John Stone, believed that once the currency was floated the dollar might increase in value, which would reduce Australian exports and stall the economic recovery that was getting underway.

The float was supported by shadow Treasurer John Howard. But the Leader of the Opposition, Andrew Peacock, the National Party and some of Keating’s Labor colleagues opposed the float, just as Malcolm Fraser had when as prime minister it was proposed to him two years previously.

Australia dollar floats

In the early hours of Friday 9 December 1983 Keating called Johnston and asked him to fly to Canberra for discussions. Meetings were held with Hawke, who was supportive of floating the dollar, as well as officials from Treasury and the Prime Minister and Cabinet departments.

By lunchtime the decision was made to float the Australian dollar when foreign currency exchange markets opened on the Monday morning.

On Monday 12 December 1983 there was real fear among investors and some in government about what would happen to the dollar. Surprisingly, however, its value rose for a few weeks but then slowly dropped over the next two years until it stabilised around 77 US cents where it roughly stayed for the next decade.

Since the float, the Australian dollar has fluctuated from a low of 47.75 US cents in April 2001 to a high of US$1.10 in July 2011.

Significance of the floating of the Australian dollar

By floating the dollar, the Reserve Bank gave up any ability to control the amount of cash in money markets and thus influence the dollar’s exchange rate. However, by the mid-1970s there was so much cash in global markets that the RBA was losing its capacity to regulate the exchange rate anyway.

By removing its responsibility to set the dollar’s value, the Reserve Bank was able to focus on keeping inflation in check through the regulation of interest rates and this in turn helped create the economic stability that characterised the 1980s and 1990s.

The floating dollar also integrated Australian markets with the world and increased confidence in the economy. The currency float helped create the groundwork for a series of deregulations initiated by the Hawke and Keating governments, including the licensing of foreign banks, the loosening of restrictions around loans, the lowering of tariffs and the move away from centralised wage regulation.

These policy shifts were facilitated by the long period of economic stability and formed the backbone of the more competitive, more international Australian economy that developed in the last two decades of the 20th century.

Explore Defining Moments

You may also like

References

David Day, Paul Keating: The Biography, Harper Collins Australia, Sydney, 2015.

Bob Hawke, The Hawke Memoirs, William Heinemann Australia, 1994.

Paul Kelly, The End of Certainty: The Story of the 1980s, Allen & Unwin, 1992.